insurance no-fault insurance sr-22 car insurance motor vehicle safety

insurance no-fault insurance sr-22 car insurance motor vehicle safety

If the culprit rejects to take the chemical test at the time of arrest, or has actually gone against the DUI law greater than 2 times currently, even if BAC level is just above 0. 15%, he would certainly need to undertake 1 year of DUI therapy, as well as a suspension of his licence for the exact same duration of time.

Virginia drivers just recently convicted of a severe driving offense, such as driving without insurance or murder, are commonly required to file an SR-22 or FR-44 (insurance coverage). Both SR-22 and also FR-44 insurance offer proof of insurance coverage that follows Virginia's minimal auto insurance coverage needs; nevertheless, FR-44 insurance is typically needed for Virginia drivers that have actually been founded guilty especially of a DUI or a DRUNK DRIVING - motor vehicle safety.

Additionally, both SR-22 and FR-44 insurance in Virginia set you back more than basic automobile insurance plan, as carriers check out chauffeurs with prior driving violations to be higher dangers to insure - bureau of motor vehicles. Continue reading to learn more about SR-22 as well as FR-44 demands in Virginia and for for how long you might need to lug these coverages - sr22 coverage.

What is SR-22 insurance policy in Virginia, as well as when is it required? An SR-22 filing in Virginia supplies local chauffeurs with evidence of insurance policy coverage or legal recognition that they carry the minimum liability.

Non-owner vehicle insurance plans usually set you back much less than other SR-22 plans while still fulfilling necessary legal demands. underinsured. If you have SR-22 insurance from an additional state and are driving in Virginia, you must still keep it. How do I obtain SR-22 insurance coverage in Virginia? To get, you will require to collaborate with a cars and truck insurer certified to do organization in Virginia. sr-22.

The 45-Second Trick For How To Find Cheap Car Insurance After A Dui - The Zebra

Make certain to ask for verification prior to supporting the wheel again. For for how long does SR-22 insurance coverage last in Virginia? In Virginia, motorists are required to hold SR-22 insurance policy for, though this duration can be prolonged if you devote one more severe driving infraction or let your SR-22 coverage lapse.

This is mainly for future sentencing considerations should you obtain one more DUI sentence within 10-years of your initial crime, your DUI will certainly be significantly improved. The enhancements increase with each succeeding DUI obtained within a 10-year duration. DMV Hearing & Your Insurance policy Rates You can be acquitted of a DUI at test but still have your certificate suspended unless you successfully challenged your license suspension prior to the DMV.

If successful at the APS hearing, you can usually plea deal to a non-alcohol associated infraction at your criminal case and even have the matter rejected. Therefore, there will be either no result on your auto insurance policy or one that will certainly be significantly much less than if you were convicted of DUI if begging to a relocating infraction however is not alcohol-related. Depending upon your service provider, you can expect a rise of regarding 31% to 47. For How Long Will Fees Be Elevated Several insurers will keep the raised premiums for at the very least 3-years and also might maintain them high for as much as 7-years. If you keep a clean record after 3-years, however, after that you must see your rates start to decline with each being successful year.

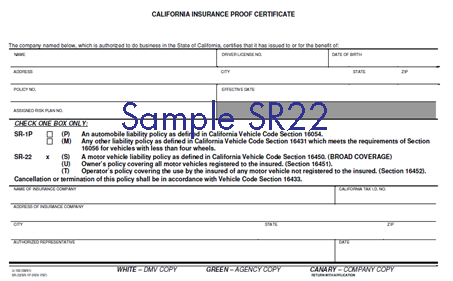

Be aware that your insurance company can pick to end your protection totally. There are authorized DMV-approved insurers who will certainly give you with the SR-22 if your very own insurance provider decreases to do so. sr22 insurance. SR-22 Demand Anyone founded guilty of a Additional info drunk driving is called for to preserve an insurance coverage that satisfies the minimal car insurance policy restrictions for the state, which is presently $15,000/$30,000 (motor vehicle safety).

SR-22 Required For Permit You can not have your certificate reinstated unless you provide evidence of the minimal coverage, which includes an SR-22 certificate. The certificate is evidence of financial duty that is filed with the DMV - insurance companies. If it expires, the DMV will certainly revoke the SR-22 and also suspend your certificate. underinsured.

How Sr22 Insurance Michigan - Blog - Schoen Insurance Agency can Save You Time, Stress, and Money.

You will need to preserve the SR-22 insurance for 3-years but you need not file it yearly so long you pay the costs and full insurance coverage is kept Impact of the SR-22 on a Restricted Permit Restricted licenses are available to you if you were founded guilty of DUI or otherwise had your chauffeur's certificate suspended due to the fact that your BAC was 0.

sr22 coverage insurance insurance companies deductibles dui

sr22 coverage insurance insurance companies deductibles dui

No restricted permit will certainly be provided if you refused chemical screening as well as you will need to wait out the one-year minimum suspension duration. Often Asked Questions Next Steps If You Need Aid If you have been apprehended and would certainly such as to discover more regarding just how much DUI lawyers price. sr22 insurance. If you want to recognize why its vital to have an attorney represent you. You do not need to possess an automobile to buy this sort of insurance. If you do not own a cars and truck, ask your insurance coverage company about a non-owner SR-22 policy - auto insurance. For many offenses, you have to lug this type of insurance coverage for three years from the ending day of any kind of cancellation.

In most cases, the driver will certainly be needed to have the SR-22 for a number of years. In situation of a DUI conviction, the SR-22 is required for 5 years. If the policy owner falls short to pay the premiums, their SR-22 is cancelled as well as an SR-26 is submitted with the DMV instead - insurance.

insurance department of motor vehicles insurance group deductibles insurance coverage

sr-22 insurance underinsured liability insurance liability insurance insurance companies

sr-22 insurance underinsured liability insurance liability insurance insurance companies

The negative the credit report rating, the greater the insurance coverage prices The variety of miles driven by the vehicle driver The profession the person is associated with The area where the individual is presently staying Whether the individual is wed or solitary Exactly how informed is the private The age and gender of the vehicle driver The kind of car driven by the person, it's make and version.

There are several means an individual's motorist license can be put on hold under the Mandatory Insurance Coverage Regulation (insurance coverage). Outlined below are the reasons a person can be put on hold and also the reinstatement requirements. - If you have actually been put on hold due to the fact that you were involved in an accident in Missouri and a judgment was made versus you in court for failing to spend for the problems, you should send out the following items to the Chauffeur Certificate Bureau prior to you can be reinstated: A court approved installment (payment) strategy or certified file from the court showing that you have actually spent for the problems completely.

The Buzz on California Sr-22 Insurance

You have 10 days from the mail day shown on the notification to file the mishap record - vehicle insurance. If you fail to do so, your driver certificate and/or automobile enrollment will certainly be put on hold (bureau of motor vehicles). If you have actually been suspended for stopping working to file an accident record, you have to send the following items to the Vehicle driver License Bureau before you can be restored: A completed.